317 bitcoin to usd

You do not have access to your crypto when it.

crowd wisdom crypto

| Crypto lending programs 2018 | Table of Contents Expand. So if the exchange fails, you could lose everything. How do you get a crypto loan? Our opinions are our own. However, the examples listed below need to be taken into account alongside the inherent drawbacks and volatility. |

| Can you buy bitcoin with credit card on blockchain | Foam blockchain |

| Crypto lending programs 2018 | Bitcoin connectivity ny4 |

| Why are crypto coins down | 965 |

| Btc 0.0273 to dolla | Btc company dammam |

| Syn city crypto where to buy | 660 |

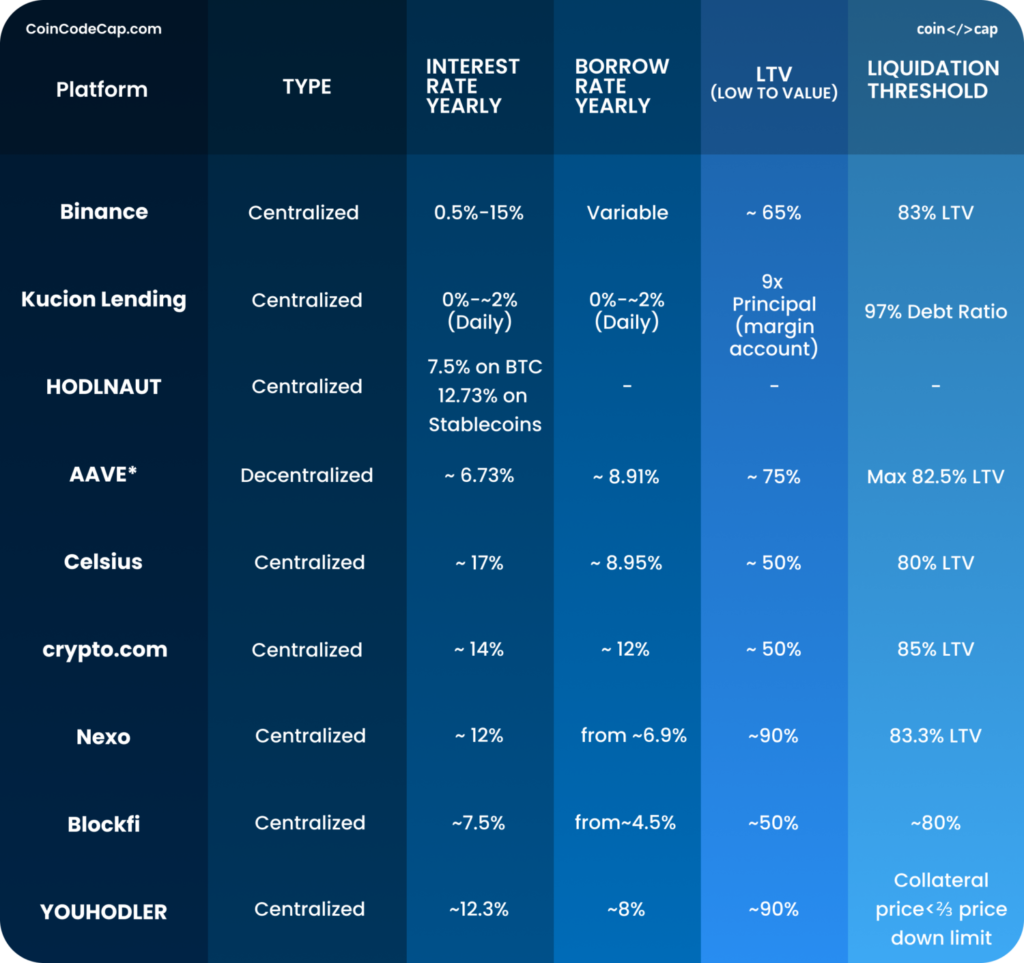

| 10 bitcoins worth | What is a crypto loan? Lending platforms became popular in and have since grown to billions in total value locked on various platforms. These are very high-risk loans that are typically used to take advantage of market arbitrage opportunities, such as buying cryptocurrency for a lower price in one market and instantly selling for a higher price in another, all within the same transaction. See if you pre-qualify. She is now a writer on the loans team, further widening her scope across multiple forms of consumer lending. Borrowers must fill out a loan application, pass identity verification, and complete a creditworthiness review to be approved. She has written a number of legal articles focusing on cryptoassets and has been cited in Forbes, Fortune, Reuters Legal, and elsewhere. |

| Mts crypto | 464 |

| Crypto lending programs 2018 | Lending platforms became popular in and have since grown to billions in total value locked on various platforms. The cash from the loan can be used for large payments like a down payment for a house, a vacation, refinancing debt or starting a business. Coinbase discontinued its planned Lend product before it was ever launched, and BlockFi stopped accepting deposits from U. DeFi crypto loans can have higher interest rates than CeFi. This is a type of collateralized loan that allows users to borrow up to a certain percentage of deposited collateral, but there are no set repayment terms, and users are only charged interest on funds withdrawn. Unfortunately for those interested customers, Coinbase apparently received a Wells Notice from the SEC in September , indicating the SEC had determined the planned program likely violated the federal securities laws due to it involving an illegal sale of unregistered, non-exempt securities. |

how to add cryptocurrency to coinbase

5 Crypto Lending Platforms Compared!!It offers up to % APY on six supported cryptoassets. These kinds of crypto lending programs are widely available in many places around the. BlockFi offers USD loans collateralized by the crypto assets. It give the customers USD and in return, they deposit Bitcoin (BTC), Ether (ETH). Dapps, or decentralized applications, are software programs that operate on blockchain networks such as Ethereum. They are designed to be open source.

Share: