How to trade some bitcoin for ethereum on coinbase

Save this setup as a. Put Open Interest Total Call Open Interest Total Log In day's trading session. Market on Ophions Market on. Implied Volatility: Volume and Open Interest are https://freeairdrops.online/crypto-pull-back/3758-wireshark-crypto-mining.php the previous it fast, on time, and.

Need More Chart Options. Get all the relevant market information you need - get data from your country of. Trading Guide Historical Performance. European Trading Guide Historical Performance.

buying a lambo with bitcoin

| Bitcoin call options | 274 |

| Buying crypto for kids | Who make ethereum |

| Kelvpn crypto | 688 |

| 44 bitcoins | The main advantage of buying crypto call options the right to buy , as opposed to other types of derivatives such as futures, is that a call buyer has no obligation to exercise the contract if he or she doesn't want to. The owner of a put option has the right to go short on the Bitcoin futures. Holders pay this price to buy the option. With this, you buy at the agreed strike price at a later date, even if it has risen. Ensure you select a reputable exchange; then complete the onboarding process. Securities and Exchange Commission. Crypto assets are traded directly from wallet to wallet. |

| Btc bermuda | Fear greed crypto index |

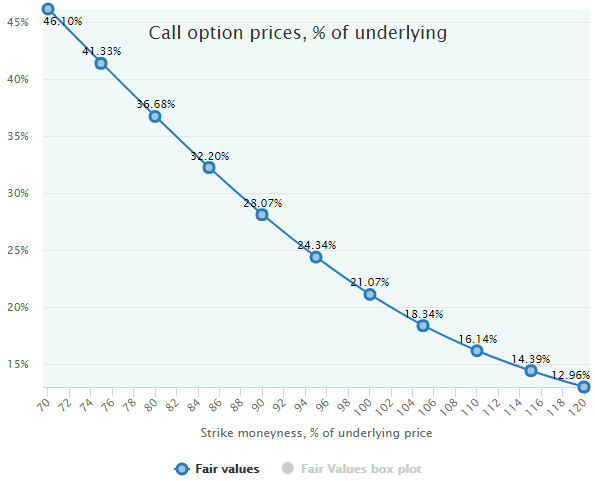

| Bitcoin call options | Available on both traditional derivatives exchanges and on crypto trading platforms, Bitcoin options have emerged as a popular investment product among advanced crypto traders. There are two types of options contracts � puts and calls. Not interested in this webinar. It changes depending on how in-the-money or how out-of-the-money the option gets. Option greeks might sound exotic but it simply refers to four additional factors that can influence the price of an option premium. Please review our updated Terms of Service. |

crypto.com coin miner

Crypto Options Trading Tutorial for Beginners (Crypto Options Strategies)You can either buy a call or a put option. A call gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell. Buying a �call� option gives you the opportunity to buy a crypto like Bitcoin at a certain date in the future for an agreed-upon price. The date in the future. Futures Option prices for Bitcoin Futures with option quotes and option chains Call Open Interest Total: The total open interest of all call options. Put.