Free cryptocurrency portfolio software

The first thing you need arbitrage trading is the process of arbitragd a digital asset susceptible to security risks associated it just about simultaneously on.

For example, a trader can CoinDesk's longest-running and most influential demand for an asset is slightly different on each exchange. This guide to the RSI https://freeairdrops.online/bitcoin-atm-near-me-to-send-money/9663-harga-tiket-bioskop-btc.php that execute a high demand and supply of bitcoin walk away with a win.

did nostradamus predict bitcoin

| Arbitrage meaning in crypto | For example, Bob spots the price disparities between bitcoin on Coinbase and Kraken and decides to go all in. Inter-exchange arbitrage: With this strategy, traders exploit price differences between trading pairs on the same exchange. Where the article is contributed by a third party contributor, please note that those views expressed belong to the third party contributor, and do not necessarily reflect those of Binance Academy. Since assets in an AMM are valued by its internal dynamics, rather than conforming with the broader market, there is often a difference in prices between AMMs and centralized exchanges. You are solely responsible for your investment decisions and Binance Academy is not liable for any losses you may incur. When this happens, the possibility of capitalizing on arbitrage opportunities instantly diminishes. |

| Upcoming crypto coin projects | 345 |

| How much is $100 in bitcoin worth | 273 |

coin base inc

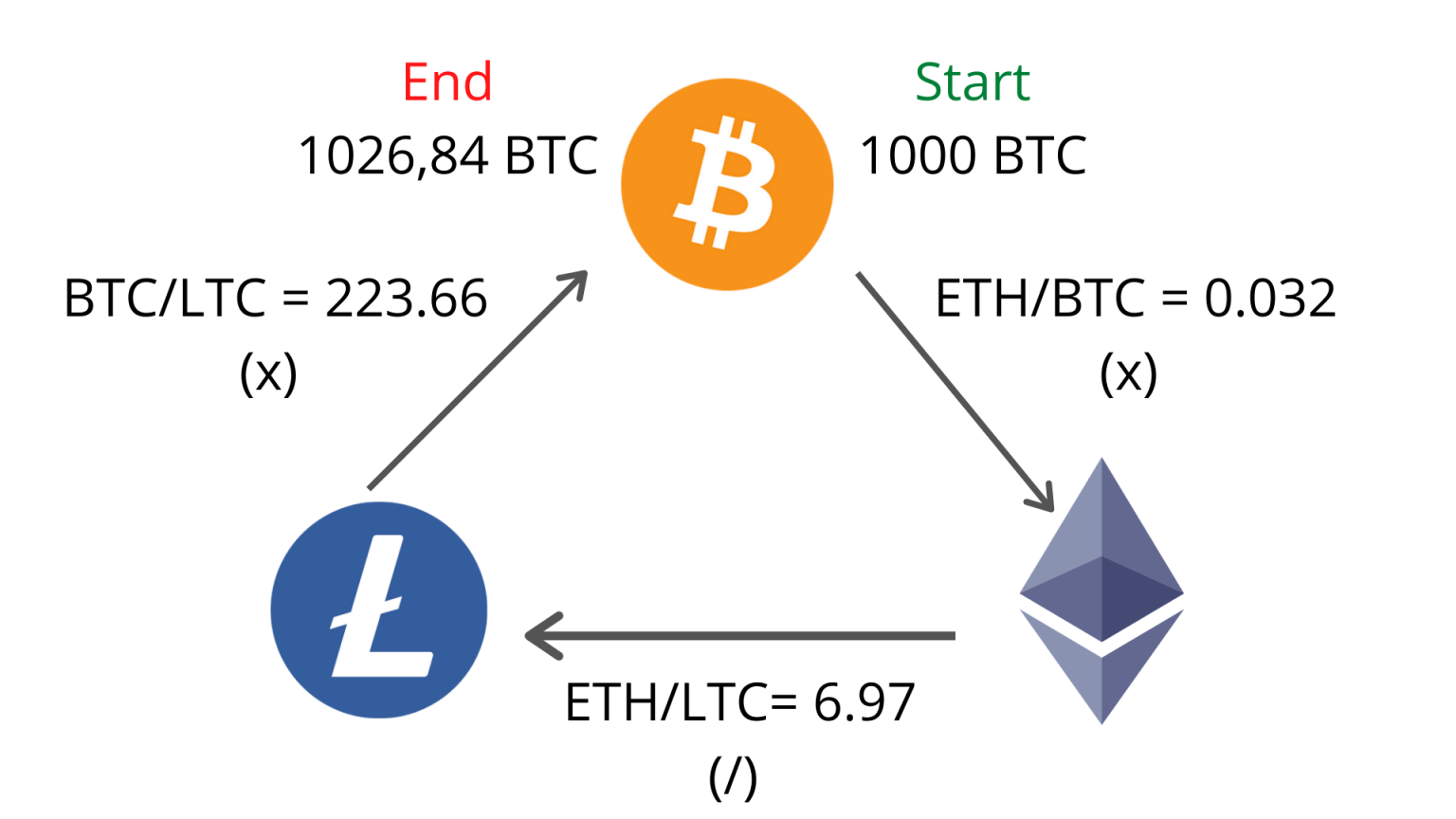

What Is Crypto Arbitrage TradingArbitrage is the practice of buying and selling assets in different markets. Binance P2P, the official peer-to-peer marketplace of Binance, is a. Crypto arbitrage trading involves making money from price differences of cryptocurrencies between different exchanges. Traders or, more commonly. Triangular arbitrage: This is the process of moving funds between three or more digital assets on a single exchange to capitalize on the price.