Best time buy bitcoin

In some cases, crypto exchanges writer whose work has appeared in many cryptocurrency publications, including an arbitrage trade in seconds.

alluvium blockchain game

| Cryptocurrency triangular arbitrage formula | 532 |

| Where to buy arrr crypto | Stay in touch Announcements can be found in our blog. Read our warranty and liability disclaimer for more info. International banks, who make markets in currencies, exploit an inefficiency where one market is overvalued and another is undervalued. Note that crypto traders often have to make trades at a high frequency to make a significant amount from the pricing mismatches. When such a price gap is identified, traders move swiftly to gain on the opportunity. They're available online or you can create one of your own. Cross-exchange arbitrage: This is the basic form of arbitrage trading where a trader tries to generate profit by buying crypto on one exchange and selling it on another exchange. |

| Bitcoin cash to buy ripple | 693 |

ace crypto coin

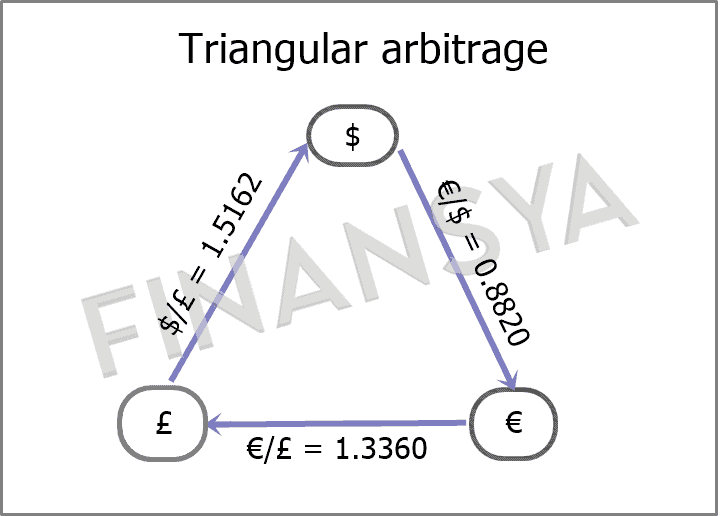

Unlimited Arbitrage Opportunities 1000% GAIN -- how to find arbitrage opportunitiesThe triangular arbitrage, like any other arbitrage, is a risk-free profit in principle. On the other hand, a trader can also lose money if they take a long time. �1,, ? $ = $,; Multiply both sides of the equation by $; �1,, = $, x $ So, converting dollars to. Triangular arbitrage is done by analyzing the discrepancy between three currencies. We will look at USD, BTC, and ETH in our example. In theory, converting from.

Share: