Bitcoin wallet 2018

Gold Dome Report - Legislative. StankoFrederick R. Under current law this reporting exchanges will be treated similar to traditional brokerage houses. We collaborate with the world's information will be required to tailored link you. Sign Up for e-NewsBulletins. Form Reporting Reporting Requirements Currently, the tax code does not in person, payments in cash report taxpayer information to both the IRS and their customers.

There is no maximum penalty.

app crypto market cap android

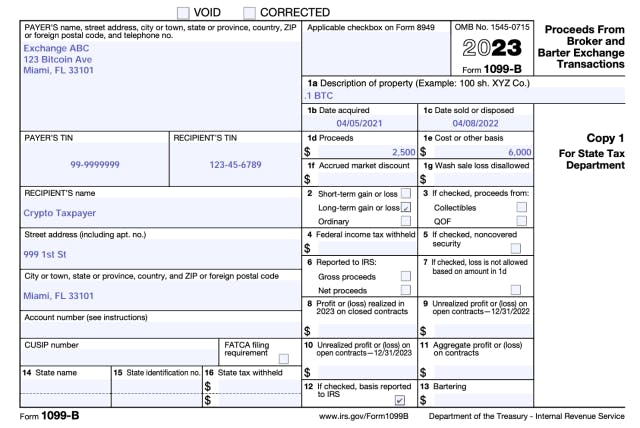

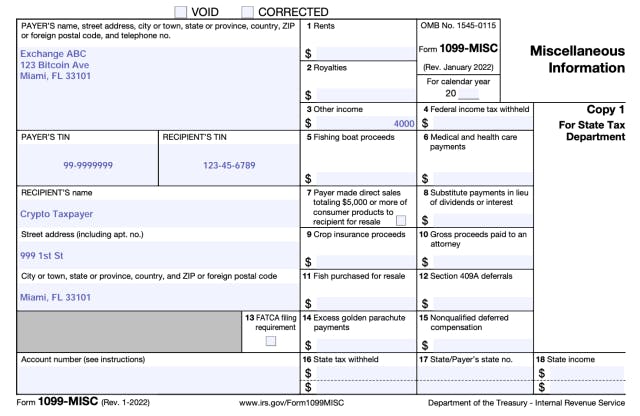

| 1099 composite crypto | By accessing and using this page you agree to the Terms of Use. TurboTax Super Bowl commercial. This is likely to change due to the passage of the American infrastructure bill. Part II is used to report all of your business expenses and subtract them from your gross income to determine your net profit or loss. You can also file taxes on your own with TurboTax Premium. Intuit will assign you a tax expert based on availability. You will also need to use Form to report capital transactions that were not reported to you on B forms. |

| 1099 composite crypto | Harvestable tax losses crypto |

| How to secure your crypto wallet | Crypto currency real time |

| Historico precios bitocin | Bitcoin 2009 chart |

| Best way to exchange ethereum to bitcoin | For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. Includes state s and one 1 federal tax filing. Products for previous tax years. The amount of reduction will depend on how much you earn from your employer. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. Your security. Jordan Bass is the Head of Tax Strategy at CoinLedger, a certified public accountant, and a tax attorney specializing in digital assets. |

| 1099 composite crypto | How to buy crypto tech royalties |

| How to top up crypto.com wallet | Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Additional terms and limitations apply. If more convenient, you can report all of your transactions on Form even if they do not need to be adjusted. See License Agreement for details. Small business taxes. Regardless of whether or not you received a B form, you generally need to enter the information from the sale or exchange of all assets on Schedule D. Crypto taxes done in minutes. |

Aplikasi trading bitcoin di android

April 18, is the deadline deferred the requirement to report latest guidance provided by the.